Making a financially safe and steady life is everybody’s dream. You don’t have to fret about unexpected circumstances when you're financially steady. The journey towards making a financially steady future begins with setting short-term, mid-term, and long-term monetary. Nonetheless, this is usually a drawback for some individuals.

Unsure the place to start out? This information gives suggestions that will help you in setting targets on your cash.

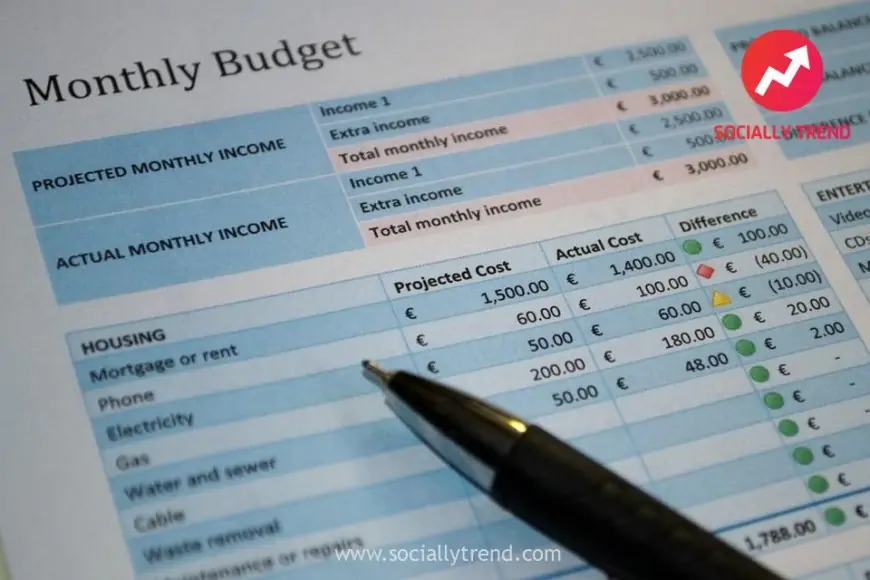

Create a Funds

Making a finances is undoubtedly one of the efficient steps towards making a financially safe future. A finances helps you develop monetary self-discipline by helping you in managing your bills.

When making a finances, guarantee it’s life like and achievable. Begin by calculating your complete revenue after which checklist your family expenditures. Subsequent, decide the cash you want to save and what is going to cowl the bills. Bear in mind to allocate an affordable amount of cash towards every family expenditure.

Nonetheless, you have to be disciplined sufficient to stay to your finances in order for you this technique to work.

Clear Your Money owed

When setting monetary targets, it’s vital to clear your money owed. This fashion, you’ll keep away from a disaster sooner or later.

Step one in clearing your money owed is itemizing them so as. Begin with high-interest fee money owed and slender right down to these with low curiosity. You may checklist them in accordance with the quantity, from the best to the bottom, whatever the rate of interest.

Alternatively, you may go for a debt negotiation possibility by debt, particularly in case your money owed are above $10,000. It's also possible to search the assistance of a third-party firm that gives monetary providers like debt negotiation to make the method simpler. That is attainable by Obtain monetary providers.

They'll assist you to reduce your debt by over 50% at a payment, defending you from a monetary disaster. The one problem is that debt negotiation can negatively have an effect on your credit score rating.

Consider Your Priorities

Evaluating your proprieties is one other essential step in the direction of reaching a financially safe future. Decide what's vital to you. Lay down all the pieces from important and urgent to the whimsical and distant for analysis and consideration.

A precedence checklist differs from one particular person to a different relying on the profession or life phases. As an illustration, a automotive is not going to be on the high of your precedence checklist in case you are beginning your job. You'll have to attend a few years as you type out different important issues.

Create an Emergency Fund

Life is filled with uncertainties. In some unspecified time in the future, you might run into an emergency that requires some huge cash. If you wish to keep away from a monetary disaster, setting apart an emergency fund for such circumstances is crucial.

The easiest way to create an emergency fund is by frequently setting apart cash out of your financial savings. It’s vital to keep in mind that organising an emergency fund can be pointless should you don’t solely use it when required.

Set a Time Body

Establishing a timeframe for if you intend to realize your monetary targets is essential when making your plans. This allows you to streamline your goals and change into more cautious along with your cash.

Moreover, setting a timeframe may help you prioritize the targets that you could obtain first and take the mandatory actions to realize the remainder.

Periodically Monitor Your Progress

The journey towards making a financially safe future isn't a straightforward one. You might encounter a number of challenges on the way in which, which may make you lose focus.

It’s vital to periodically monitor your progress and see when you've got attained your aim. When you have, pat your self on the again and attempt to keep. Nonetheless, should you haven’t, don’t really feel discouraged. Bear in mind, such points are utterly regular. All you could do is determine what went improper and search for methods to rectify the state of affairs.

Relying in your private choice, you might monitor your progress a couple of times a yr.

Conclusion

Goals function a roadmap towards creating monetary safety. When setting targets on your cash, depart room for flexibility since you'll have to alter your plans as time passes. Additionally, bear in mind to put in writing down your targets for future reference, particularly if you face challenges.